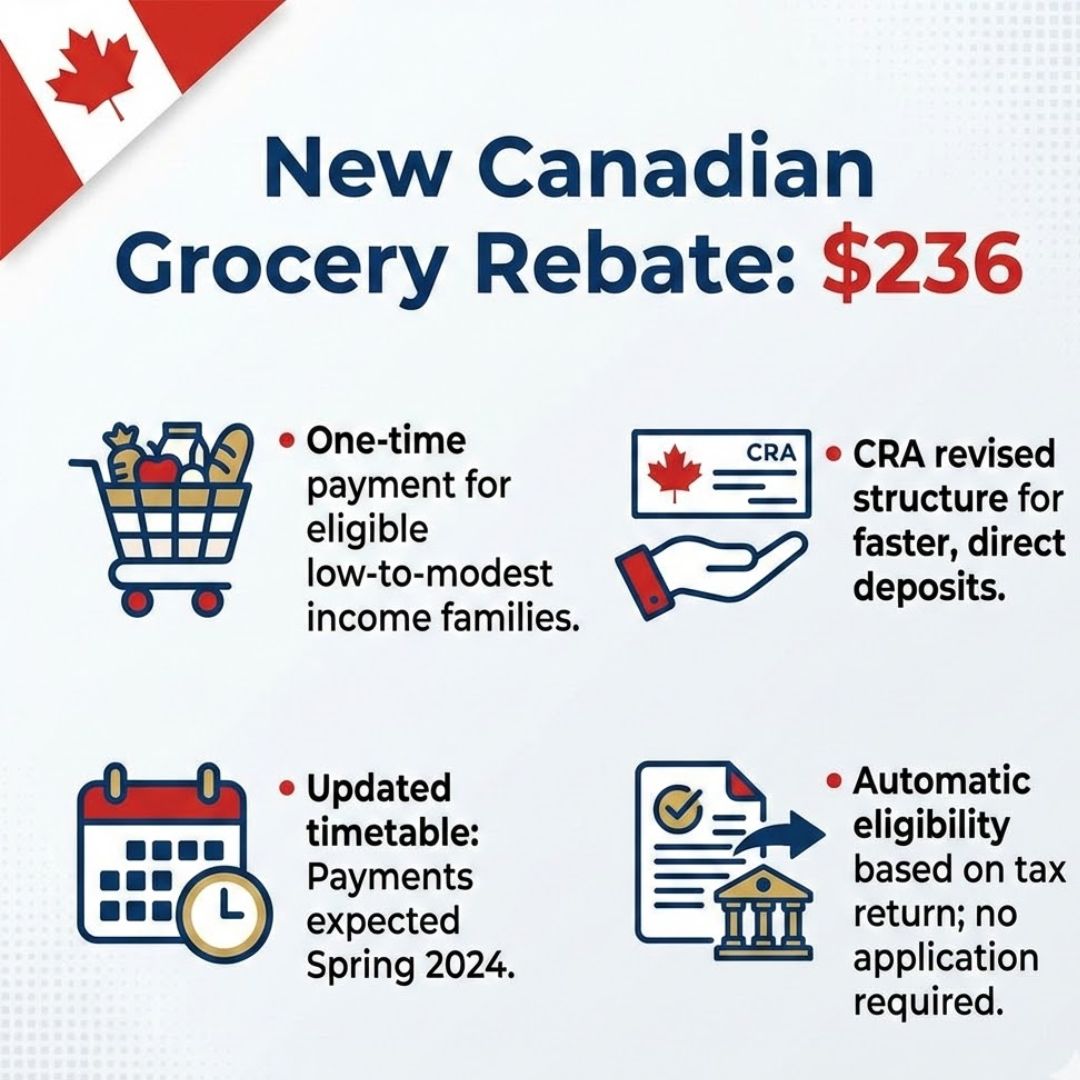

Canada Revenue Agency Confirms $236 Grocery Rebate for 2026 The Canada Revenue Agency has announced a $236 Grocery Rebate to assist Canadian households facing increased food expenses in 2026. This single payment focuses on supporting low- and middle-income Canadians who are experiencing difficulties due to inflation and elevated grocery prices. Food costs have been rising steadily throughout the country. The rebate provides additional financial assistance to eligible Canadians during this period of economic pressure. Understanding the qualification criteria & payment details will help you determine if you can receive this support.

CRA Grocery Rebate Update for Canadian Residents

The latest CRA Grocery Rebate update demonstrates the federal government’s ongoing efforts to assist Canadians facing high inflation. This enhanced grocery relief program focuses on households experiencing the greatest difficulty with increasing food costs and basic living expenses. Canadians who currently qualify for the GST/HST credit will receive the grocery rebate automatically. This applies to families as well as seniors and individuals. There is no need to submit a separate application since the CRA determines your eligibility through your tax return information. This streamlined approach provides people with quicker access to financial assistance. It also reflects the government’s dedication to helping Canadians navigate rising cost-of-living pressures.

New Grocery Payment Support Confirmed for Families in Canada

The announcement of extra grocery payment help for Canadian families shows an ongoing effort to deal with rising living costs. The CRA decides payment amounts by checking household income details from last year’s tax return to make sure support goes to those facing the biggest financial problems. This grocery rebate gives many families some additional financial room each month and helps them handle the cost of basic food while reducing everyday money worries. With inflation still affecting what households pay for necessities this payment offers practical help and short-term financial stability.

| Household Type | Approximate Rebate Amount | Eligibility Criteria | Payment Delivery Method |

|---|---|---|---|

| Single Adult | $230 – $240 | Must meet GST/HST credit eligibility guidelines | Direct deposit or cheque by mail |

| Married or Common-Law Household | Up to $310 | Total household income must fall within CRA limits | Direct deposit or mailed cheque |

| Senior Individual | Approximately $240 | Eligibility determined automatically using CRA records | Issued automatically |

| Family with One Child | About $370 | Families approved for GST/HST credit support | Automatic payment |

| Family with Two or More Children | $410 or more | Final amount depends on family size and income level | Automatic payment |

Enhanced Food Rebate Benefits for Canadians Nationwide

The enhanced food rebate for Canadians offers financial support during a time when living expenses remain elevated throughout the nation. This rebate assists families in managing increased grocery costs and other necessary expenses whether they live in major cities or rural areas. The CRA distributes payments efficiently to qualified individuals using either direct deposit or mailed cheques. Payment amounts depend on household size and annual income to help families maintain their standard of living and ensure financial stability during 2026.

Grocery Relief Program Details for Citizens of Canada

The grocery relief program relies on GST/HST credit eligibility to determine who qualifies. This method allows the CRA to assess recipients fairly while avoiding additional paperwork requirements. The government delivers payments automatically to ease the burden on families already facing financial constraints. This efficient system addresses immediate financial needs while contributing to the ongoing economic stability of millions of Canadians who need government assistance to purchase essential items.

Goodbye to CPP Old Rates: Monthly pensions rise to $1,760 as Canada resets payments January 9

Goodbye to CPP Old Rates: Monthly pensions rise to $1,760 as Canada resets payments January 9