Canadian households are continuing to face pressure from rising food costs, making the federal $236 Grocery Rebate an important source of short-term relief. Managed by the Canada Revenue Agency, this one-time payment is intended to support low- and modest-income families with everyday grocery expenses. With updated guidance now released, many Canadians are seeking clear information about payment dates, eligibility criteria, and how the rebate fits within existing federal assistance programs. Knowing when and how this payment arrives can help families plan their monthly budgets with greater confidence across the country.

Canada Revenue Agency Grocery Rebate Payment Timeline Explained

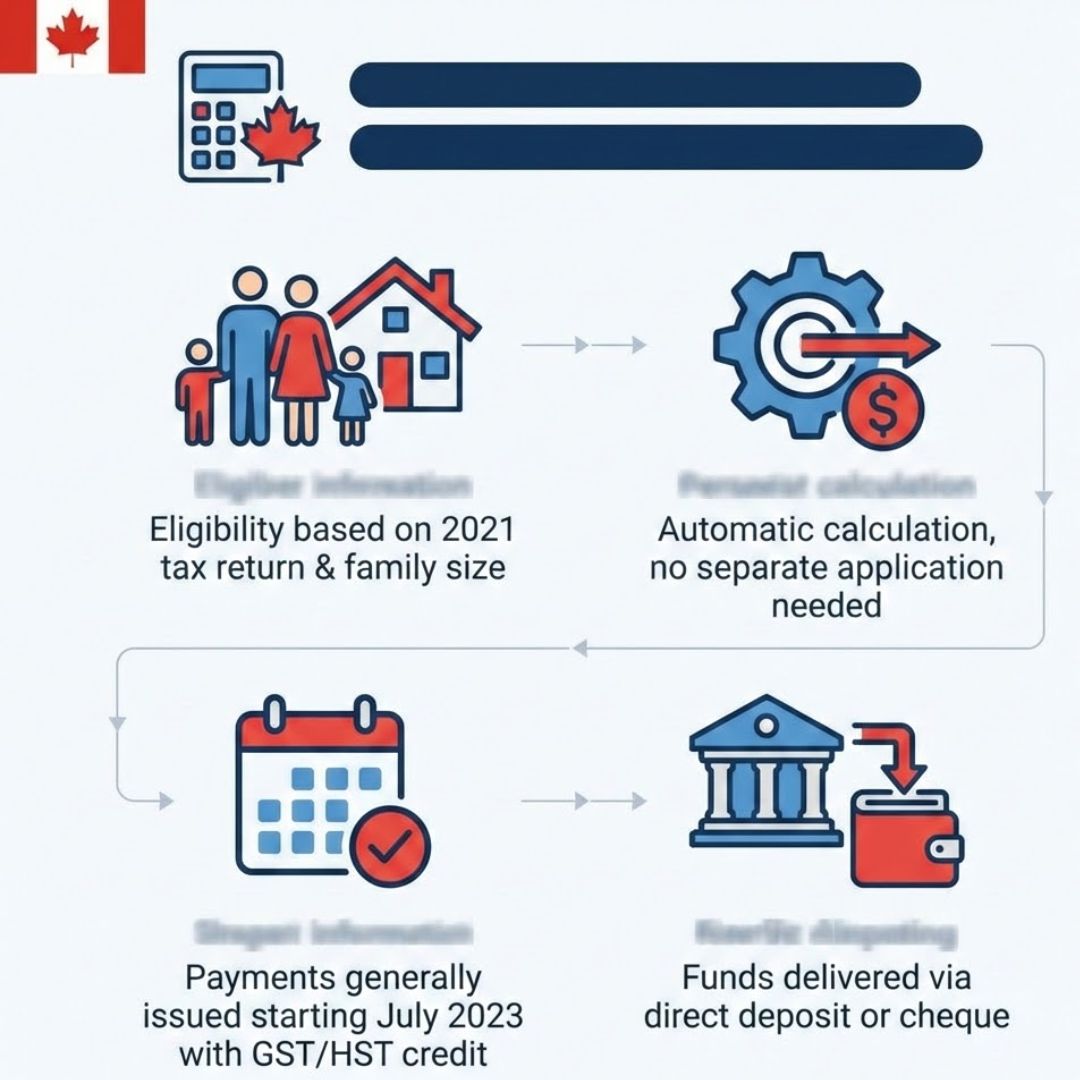

The Canada Revenue Agency has provided a straightforward payment timeline so eligible households know what to expect. The grocery rebate is issued automatically, meaning no separate application is required as long as tax records are current. Payments are delivered through direct deposit or by cheque, depending on how recipients normally receive government benefits. This approach is designed to deliver timely support during periods of high food inflation, offering direct financial relief when household budgets are under strain. For many families, the rebate acts as short-term assistance that complements existing credits, with a focus on quick and simple delivery.

Federal $236 Grocery Rebate Eligibility Rules for Canadian Households

Eligibility for the $236 Grocery Rebate is closely linked to existing income thresholds used by the CRA. In most cases, individuals and families who qualify for the GST/HST credit are also eligible for this payment. Factors such as household income, family size, marital status, and reported earnings help determine the final rebate amount. This structure ensures the support is directed toward households experiencing higher food cost pressure, while maintaining fairness across different regions. For eligible recipients, the rebate provides additional grocery support alongside other benefits, without requiring extra paperwork.

How the $236 Grocery Rebate Helps Canadian Families During Inflation

Although the grocery rebate is a one-time payment, it can still make a noticeable difference in managing daily expenses. Many families use the funds to cover grocery bills, allowing them to redirect income toward essentials like utilities or transportation. In the context of ongoing inflation, the rebate offers practical food-related support rather than long-term income replacement. It also reflects a broader government response to rising living costs affecting households nationwide. For seniors, parents, and low-income workers, the payment provides temporary relief that helps ease short-term financial pressure.

Goodbye to CPP Old Rates: Monthly pensions rise to $1,760 as Canada resets payments January 9

Goodbye to CPP Old Rates: Monthly pensions rise to $1,760 as Canada resets payments January 9

What the Updated Grocery Rebate Means Going Forward

The latest guidance on the grocery rebate shows how targeted payments are being used to address cost-of-living challenges. While it does not solve long-term food price inflation, it delivers immediate household assistance that many Canadians depend on. Keeping tax filings up to date remains essential to avoid payment delays. Looking ahead, similar measures may continue as economic conditions change. Overall, the rebate represents short-term financial breathing room for families managing tight budgets while broader affordability strategies continue to evolve.

Canada Revenue Agency Grocery Rebate Overview

| Detail | Information |

|---|---|

| Rebate Amount | $236 one-time payment |

| Administered By | Canada Revenue Agency |

| Eligibility Basis | GST/HST credit criteria |

| Payment Method | Direct deposit or cheque |

| Application Required | No separate application needed |