As 2026 approaches its final weeks, many Canadians are hearing discussions about a possible $1,350 one-time payment linked to the Canada Revenue Agency and expected around January 11 2026 . This proposed support is being viewed as year-end financial relief to help individuals and households manage rising living costs. With housing, groceries, utilities, and transportation becoming more expensive nationwide, a lump-sum payment of this size could ease pressure for those struggling to meet basic expenses. This rewritten guide explains what the $1,350 payment is expected to involve, who may qualify, how it could be delivered, and how it fits alongside existing federal benefits. It also outlines practical steps Canadians can take now to avoid delays.

CRA Schedules $1,350 One-Time Deposit

The $1,350 amount is being described as a one-time, non-taxable deposit administered through the Canada Revenue Agency. Unlike recurring programs such as the GST/HST credit or the Canada Child Benefit, this payment would be a standalone measure designed to provide short-term financial relief near the end of the year. Importantly, it is not intended to replace or reduce any existing federal benefits. Instead, it would act as an additional layer of support, delivering immediate assistance without creating permanent changes to current benefit programs.

What Is the $1,350 One-Time CRA Deposit?

The proposed deposit would be issued once and would not continue into future years. Because it is expected to be non-taxable, recipients would not need to report it as income on later tax returns. This approach ensures the full value reaches eligible individuals without affecting other income-tested benefits.

Why January 11 2026 Is the Planned Payment Date

Late January is commonly used for government relief payments, especially around major holidays. Issuing funds before the year ends helps ensure access despite reduced banking hours and office closures during the Christmas period. Household expenses also tend to rise at this time of year due to heating costs, higher grocery spending, travel, and year-end bills. A January 11 deposit aligns with these seasonal financial pressures.

Who May Qualify for the $1,350 Payment

Final eligibility rules have not yet been officially released. However, expectations suggest the criteria will closely follow existing CRA benefit systems, relying on residency status, income levels, and recent tax filings.

Canadian Residency Requirement

Individuals would need to be residents of Canada for tax purposes when eligibility is assessed. This determination would be based on information already held by the CRA from recent tax filings.

Tax Filing Requirement

Eligibility is expected to rely on the most recent income tax return, likely from the 2024 tax year. Even Canadians with little or no income would still need to file a return, as the CRA uses this data to assess qualification.

Income-Based Eligibility

The payment is widely expected to be income-tested, with priority given to low- and middle-income individuals. Higher-income earners may receive a reduced amount or may not qualify, depending on final thresholds.

Adults and Households

The deposit is anticipated to be issued on a per-adult basis. In couples or family households, more than one adult could qualify, which may increase the total support received, subject to income limits.

How the $1,350 Amount Is Structured

The $1,350 figure is expected to be a flat, one-time amount rather than a phased or recurring benefit. This structure simplifies administration and ensures eligible recipients receive the full amount in a single payment.

Individual Payments

Each eligible adult may receive up to $1,350. In households where two adults qualify, the combined support could reach as much as $2,700, depending on income and eligibility rules.

Non-Taxable Treatment

The payment is expected to be non-taxable, meaning it would not count as income and would not reduce other federal benefits tied to income thresholds.

How the Payment Would Be Issued

The CRA is expected to use existing payment systems to deliver the funds, reducing administrative delays and ensuring consistency with other federal benefits.

Direct Deposit

Canadians registered for direct deposit with the CRA would receive the payment automatically in their bank accounts on January 11, 2026 . This remains the fastest and most reliable delivery method.

Cheque by Mail

Those without direct deposit set up would receive a paper cheque mailed to their address on file. Holiday mail volumes could result in delivery delays beyond the scheduled date.

How This Deposit Fits With Existing CRA Benefits

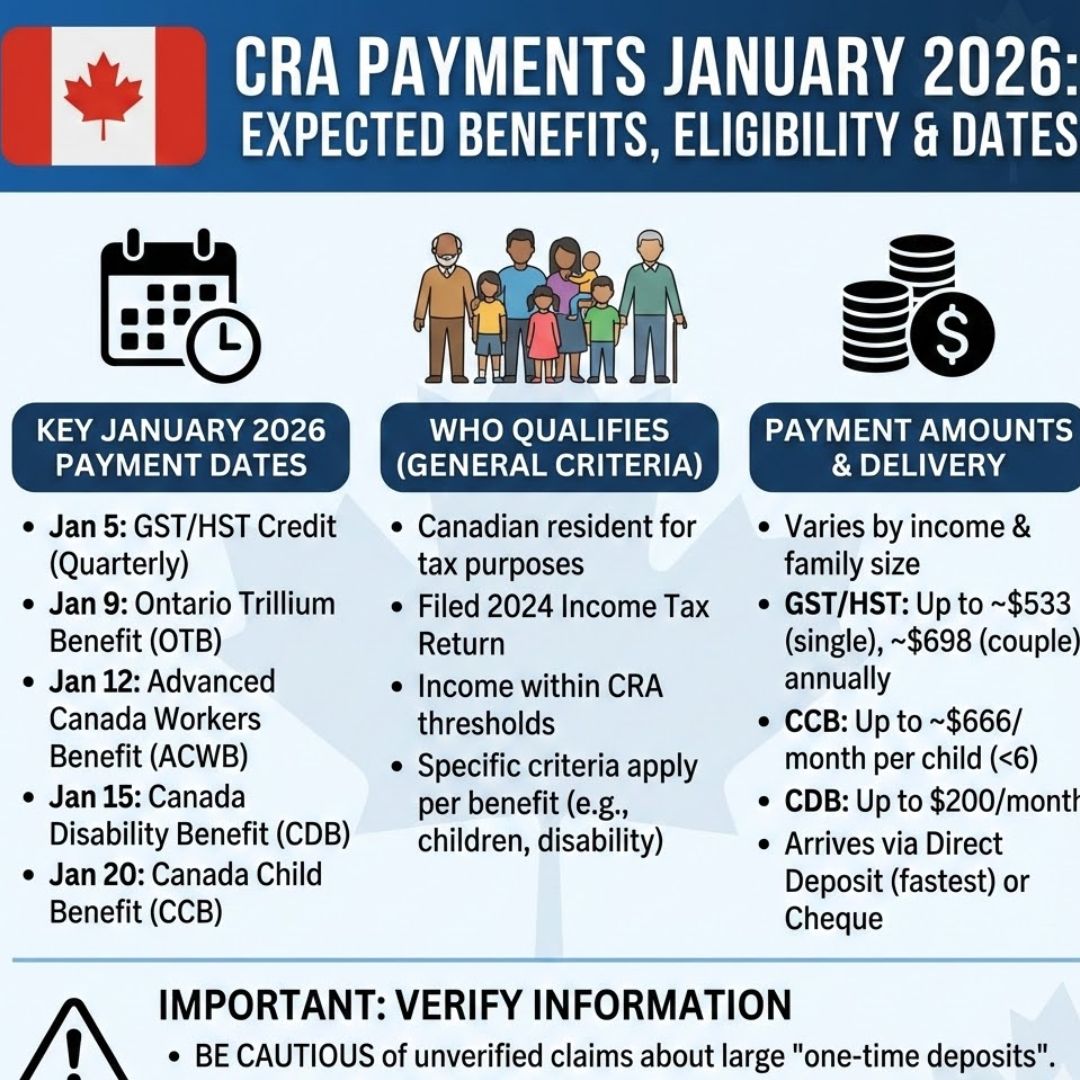

The one-time $1,350 payment is expected to remain separate from ongoing programs such as the GST/HST credit, Canada Child Benefit, Old Age Security, Guaranteed Income Supplement, Canada Pension Plan benefits, and Climate Action Incentive payments. It should not affect benefit calculations for 2026.

What Seniors Should Keep in Mind

Seniors on fixed incomes may find this payment especially helpful. Filing tax returns remains essential, even with minimal income. A non-taxable payment should not affect OAS or GIS, and couples may qualify for two payments if both partners meet eligibility requirements.

What Families and Low-Income Canadians Can Expect

For households already receiving federal benefits, the payment may be issued automatically if eligibility conditions are met. Funds could be used for groceries, heating, winter clothing, transportation, or reducing outstanding bills.

Steps to Take Now to Prevent Delays

To reduce the risk of delays, Canadians should ensure their latest tax return is filed and processed, confirm direct deposit details, and update personal information such as address or marital status with the CRA.

Common Reasons Payments May Be Delayed or Reduced

Delays or reductions may occur due to unfiled tax returns, income exceeding eligibility limits, incorrect banking details, changes in household composition, or unclear residency status.

Staying Alert to Misinformation and Scams

Highly publicized payments often attract scams. Canadians should be cautious of messages asking for banking details or fees. Legitimate CRA payments are automatic and handled through secure channels.

Why Governments Use One-Time Payments

One-time payments allow governments to respond quickly to rising costs without permanently changing benefit programs. They are often used during periods of inflation or increased living expenses.

Planning for the January 11 Deposit

Households expecting the $1,350 payment may choose to apply it toward winter expenses, debt reduction, savings, or early 2026 costs. As a non-taxable lump sum, it provides flexibility to meet individual financial priorities.

Goodbye to CPP Old Rates: Monthly pensions rise to $1,760 as Canada resets payments January 9

Goodbye to CPP Old Rates: Monthly pensions rise to $1,760 as Canada resets payments January 9