The Canada Revenue Agency and Service Canada have released the confirmed direct deposit schedule for Canada Pension Plan (CPP) and Old Age Security (OAS) payments for January 2026. These monthly benefits remain a vital source of income for millions of Canadian seniors, especially as inflation and rising living costs continue to strain household budgets. Receiving CPP and OAS payments on time allows retirees to better manage essential expenses such as rent, utilities, groceries, and healthcare. The federal government is urging all beneficiaries to keep their banking information and personal records up to date to avoid any delays during the holiday payment period.

Canada Updates CPP and OAS Payment Planning

As part of its year-end payment planning, Canada has adjusted its CPP and OAS timelines to ensure seniors receive their benefits smoothly in January 2026, even with holiday-related processing changes.

Goodbye to CPP Old Rates: Monthly pensions rise to $1,760 as Canada resets payments January 9

Goodbye to CPP Old Rates: Monthly pensions rise to $1,760 as Canada resets payments January 9

Understanding Canada Pension Plan (CPP) Benefits in 2026

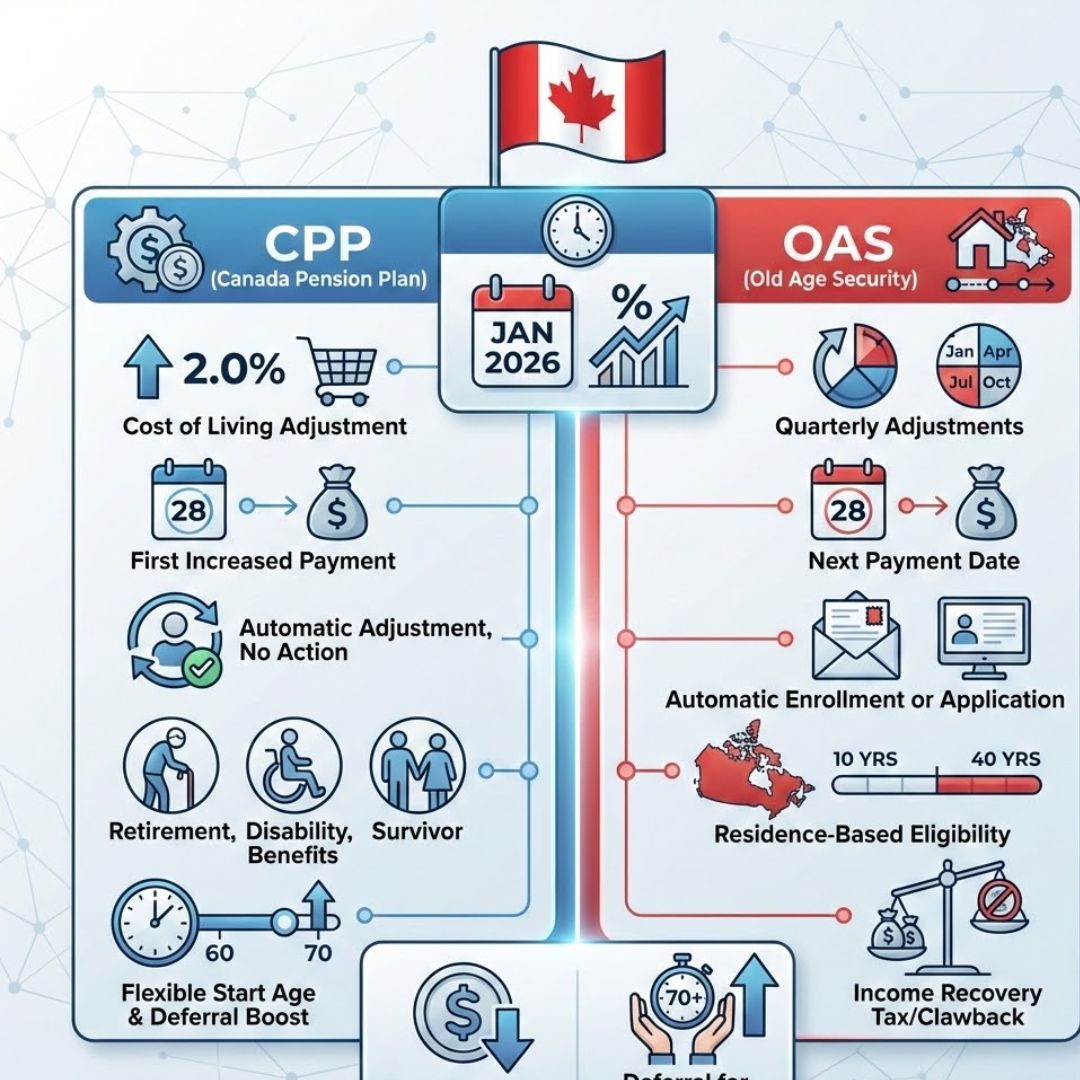

The Canada Pension Plan is a national retirement program that provides monthly income to Canadians who contributed to the plan during their working years. CPP payments are designed to replace a portion of employment income after retirement.

How CPP Retirement Payments Are Calculated

Your CPP retirement benefit is calculated using several important factors. The total amount you contributed during your working life plays a central role. The number of years you made contributions also affects your final monthly payment. The age at which you begin collecting CPP is another key element. You can start as early as age 60, but choosing to delay benefits up to age 70 results in higher monthly payments. The longer you wait beyond the standard retirement age, the more your pension increases. These factors combined determine your final CPP retirement income.

Average CPP Payment Amounts for 2026

CPP retirement payments in 2026 will vary based on each individual’s contribution history. Most Canadian retirees receiving CPP can expect monthly payments ranging approximately between $760 and $1,300. The exact amount depends on how much and how long you contributed to the plan.

Additional Benefits Available Under CPP

In addition to retirement income, the Canada Pension Plan also offers disability benefits for individuals who are unable to work due to illness or injury. Survivor benefits are available for spouses and dependent children after a contributor passes away. CPP also provides post-retirement benefits for people who continue working while receiving CPP payments.

Old Age Security (OAS) Program Explained

The Old Age Security pension provides monthly financial support to Canadians aged 65 and older. Unlike CPP, OAS is funded entirely through general tax revenue. Eligibility does not depend on employment history or previous contributions.

January 2026 CPP and OAS Direct Deposit Date

The Government of Canada has confirmed that CPP and OAS direct deposits for January 2026 will be issued on , January 28, 2026. Most recipients using direct deposit should see the funds in their bank accounts on that day or the next business day. Seniors receiving paper cheques may experience a delivery time of 5 to 10 business days, depending on postal service timelines. Due to the holiday season, some official calendars indicate an earlier processing date of January 22, 2026, to ensure payments arrive before Christmas.

Official 2026 CPP and OAS Payment Schedule

| Month | CPP & OAS Deposit Date (2026) |

|---|---|

| January | 29 January 2026 |

| February | 26 February 2026 |

| March | 27 March 2026 |

| April | 29 April 2026 |

| May | 28 May 2026 |

| June | 26 June 2026 |

| July | 29 July 2026 |

| August | 27 August 2026 |

| September | 26 September 2026 |

| October | 29 October 2026 |

| November | 28 November 2026 |

| December | 22 December 2026 (early holiday release) |

How to Set Up Direct Deposit for CPP and OAS

Direct deposit remains the fastest and safest way to receive CPP and OAS payments. Seniors can enroll by logging into their My Service Canada Account and selecting the Direct Deposit option under benefits. You will need to enter your bank’s transit number, institution number, and account number before confirming your details. Many major Canadian banks also allow you to link CPP and OAS payments directly through online banking.

How to Track and Verify Your CPP and OAS Payments

If a payment does not arrive as expected, check your bank account for recent deposits and log in to your My Service Canada Account to review payment status. Make sure your banking details and mailing address are correct.

For mailed cheques, allow up to 10 business days for delivery. If issues persist, seniors can contact Service Canada at 1-800-277-9914 for further assistance.

Tips to Prevent CPP and OAS Payment Delays

To avoid delays in January 2026, seniors should file their 2024 income tax return on time and keep all personal information current. Any changes to banking details, address, marital status, or residency should be reported promptly. Enrolling in direct deposit instead of relying on mailed cheques significantly reduces the risk of payment disruptions.

How CPP, OAS, and GIS Work Together

Many Canadian seniors receive CPP, OAS, and the Guaranteed Income Supplement (GIS) at the same time. These benefits are usually paid on the same monthly date, making budgeting easier. In January 2026, eligible seniors may receive all three payments together, providing valuable financial support ahead of peak winter expenses.